True Fiduciary Financial Advisors

Wallace R. Nichols, M.B.A., J.D., CFP® Professional

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER™ certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Asset Guidance Group, LLC, a registered investment advisor

Our Team

True Fiduciary Financial Advisors who put your best interests first--every time!

Hi, my name is Jarod W Nichols. I am a problem solver. My skill sets enabled me to stay calm under pressure and keep sight of mutually beneficial outcomes. This ability has enabled me to produce positive financial outcomes for thousands of American consumers at a high level for the last decade.

I graduated From Arizona State University with Degree of Bachelor of Arts in Communication.

In my varied professional roles in the mortgage industry, I helped thousands American consumers actualize and maintain the dream of homeownership regardless of trying circumstances. I did this by carefully analyzing their existing budgets and helping them develop new budgets to take maximum advantage of regulatory allowances.

I hold an Insurance and Annuity license in the state of Georgia. I am also a registered investment adviser representative in the state of Georgia.

So, all of the above is what true fiduciary financial advisors do to ensure that clients’ best interests come first, not those of the advisor. Contact me at the listed points. I am excited to contribute my talents and proficiencies in problem solving toward your retirement.

Here are 3 surefire ways to find a true fiduciary financial advisor:

- Experience: find an advisor with the experience to serve as your personal Chief Financial Officer;

- Integrity: find an advisor with a proven track record of satisfied, happy clients; and

- Trust: find an advisor who legally is a fiduciary–duty bound to put your best interests first by eliminating conflicts of interest so you know you can trust them.

We are true fiduciary financial advisors as we satisfy all three elements. We provide fee-based services. We have superior skills and the hard-earned experience required to effectively manage risks associated with social security, tax, asset protection, long-term care, wealth accumulation, and legacy planning.

Hi. My name is Wallace R Nichols, JD, MBA, CFP® Professional. I go by Wally. The “JD” stand for juris doctorate; yes, I’ve been a lawyer for over 26 years and have spent the last 12 years focusing on estate planning.

The MBA stands for Master of Business Administration. My focus of study was statistical financial forecasting. I spent my late 20s in the Northeastern USA working for BIG corporations. Once, Time Magazine gave me an award for teaching them a then-cutting-edge financial forecasting system.

The CFP® Professional designation means that I’m a Certified Financial Planning Professional, having passed all Ethics, Experience, Background, Education, and Examination requirements promulgated by the CFP® Board.

Now, of course I’m going to brag about my credentials–I’m applying for a job to be your wealth management advisor! But I come from very humble beginnings.

I grew up in a trailer-house in the oilfields of Eastern New Mexico/West Texas. I started working for pipeline contractors at age 15 for summer work. After a knee injury that cost me my college athletic scholarship, I worked as a utility repairman rebuilding 2,500 horse-power engines that drove natural gas compressors to move natural gas down those pipelines (350 million cubic ft/day). At age 22, I operated 3 of those compressor-gathering-stations. It took an education to get out of those situations. So I got several. Good thing I learned to read well early on! Ok, back to now–and how I can help YOU!

First and foremost, I am a true fiduciary financial advisor. I manage your planning with your best interest paramount, even as to my own. I’ve been a practicing lawyer for over 26 years. So being a true fiduciary financial advisor is nothing new to me.

I am a financial and legal educator. Besides being an educator, I am a wealth, estate, and financial planner licensed to practice around the nation. I hold FINRA Series 7 & 66 licenses. I am the principal for Asset Guidance Group, LLC, a registered investment advisor with the SEC and Georgia Secretary of State’s office.

I’m community minded. I was on the 2020 Board of the Georgia Financial Planning Association (FPA). I volunteered as a Citizen on Patrol with the Dunwoody Police Department from 2018-2019. I functioned on the litigation advisory board for the National Association of Elder Law Attorneys from 2015-2018.

My educational background besides having a juris doctorate is my MBA in quantitative analysis and information systems. I have a Bachelor of Business Administration Degree majoring in Accounting and Finance. I began my financial career in the financial services industry with the New York Life Company after leaving corporate America (Mobil Oil/GTE) in the late 1980s. New York Life had one of the best industry educational development programs in the nation at that time. I left New York Life in the mid-90s and have been a sole practitioner and ran my own practice since that time.

I am also an attorney licensed to practice in the States of Georgia, Arizona and am an active member in those State Bars, although I’m now inactive member of the DC Bar. I’ve litigated cases before the Supreme Court of Georgia, the Georgia Court of Appeals, the Arizona Court of Appeals, and practiced in state and federal courts about the nation for 26 years.

Although I’m not a CPA, I am qualified to represent you before the IRS, to prepare your taxes, and even represent you before the IRS in administrative proceedings or in federal court. I routinely teach continuing professional education classes to lawyers, CPAs, and financial planners through NBI, the National Business Institute in ethics, taxes, wills, estates, and trusts, business entity formation, and tax implications for all of the above. So, we will be discussing things that have tax and estate planning implications. It’s hard to discuss retirement planning without bringing these things into the mix.

I’m also an active member and CFO of the Center for Holistic Education in Retirement Planning, a 501(c)(3) non-profit organization (CHERP). CHERP is a non-profit organization dedicated to helping pre-retirees and recent retirees improve their lives by providing adults with opportunities for improved comprehensive personal finance education that is not designed with a sole purpose of merely to pitch an insurance product.

These courses are conducted on university and college campuses across the country and are designed to increase awareness about financial issues so that class attendees can make more informed decisions about their retirement.

So, who better to discuss retirement planning, longevity risk planning and the changes in the legal and financial worlds related thereto, than someone who has already immersed himself into these topics and actually helped people through such crises?

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER™ certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Wondering how to find a true fiduciary financial advisor? A true fiduciary is someone who is legally bound to act in their clients’ best interests and to disclose any potential conflicts of interest. We avoid conflicts of interest by making full disclosures in writing via our Firm Brochure, or Form ADV. Form ADV is a document that Registered Investment Advisors are required to file with the State and Securities and Exchange Commission (SEC) that provides information about their business practices and potential conflicts of interest.

Often, people have very complicated situations and roadblocks that stand in the way of them ultimately living the life they’ve dreamed for themselves. We perform cash-flow analysis, portfolio analysis and risk assessments, to create a way to achieve your financial, business, and legal goals. We term this process, “Find a Way to Win!” We do so in a way that is proven to be in your best interests, not ours.

We use a very sophisticated financial application for securely analyzing your financial information, including long-term tax impact. We can efficiently create “what-if” scenarios to see how resilient your situation and plan is for life’s curveballs. We run 1,000 Monte-Carlo simulations on every portfolio to determine the long-term viability of current and recommended scenarios.

We also use a secure, encrypted portal for uploading, transferring, and storing in one central location, your confidential financial statements, planning, and legacy documents. It’s much more private and secure than emailing these types of informational exchanges. We’re very sensitive to people’s privacy concerns.

And all that is how we prove ourselves to be true fiduciary financial advisors!

As true fiduciary financial advisors managing assets, we see our mission as follows:

- Identify the trends;

- Select the outperformers;

- Manage risk actively to avoid excessive drawdowns without compromising potential for excellent upside gains.

We use a proprietary formulaic approach to wealth management. We begin with investment consulting. This process involves:

- Portfolio performance analysis

- Risk evaluation

- Asset allocation

- Cost impact assessment

- Tax rate impact assessment

- Investment policy statement

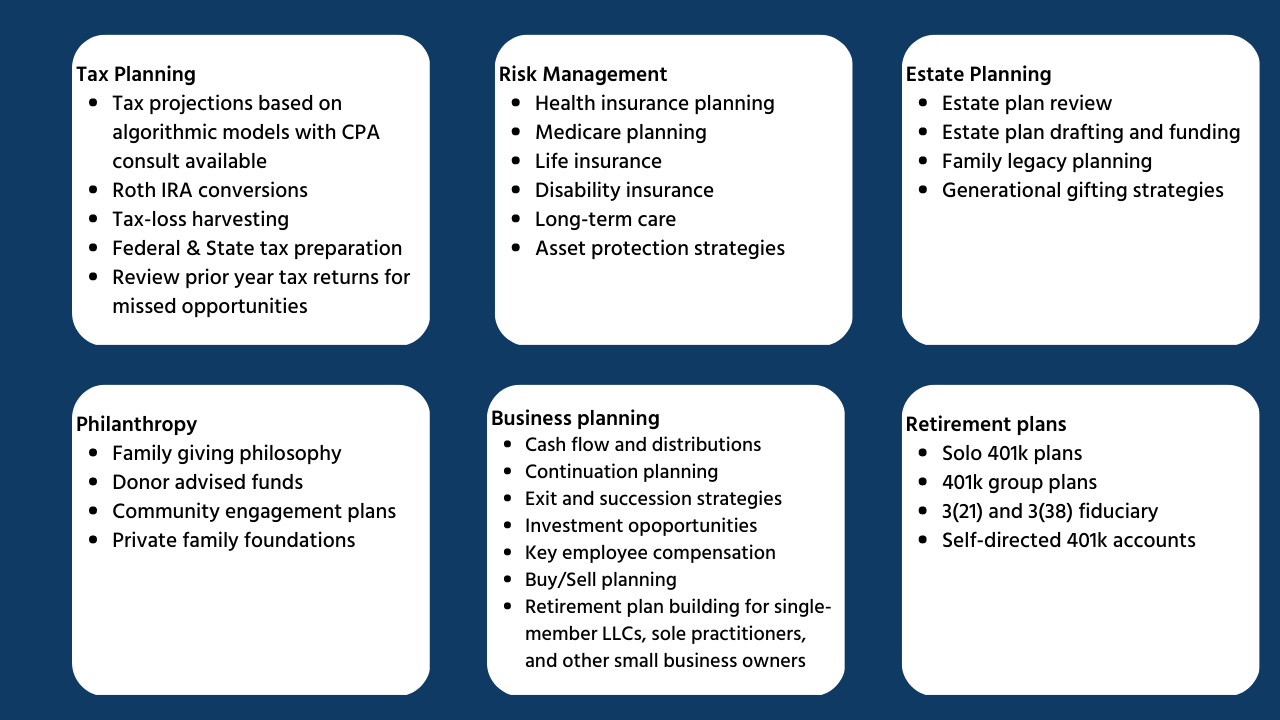

Next, if you’ve onboarded as a client, we move into the Advanced Planning stage. We discuss tax mitigation, wealth transfers, protection, and charitable giving.

Incorporated into the Advanced Planning process is relationship management with other professionals involved in your case.

By using this formula, we ensure that we fully understand your personal risk tolerance in the context of your situation. Because wise advice includes more than a mere number as a risk score. And by providing truly holistic plans and managing assets to those milestones set forth in your plan, we ensure that we fulfill our responsibilities to you as true fiduciary financial advisors.

We offer High-Net-Worth level services, no matter your wealth level

Because everyone deserves access to superior, comprehensive investment strategies, financial services, and advice. That’s the type of services true fiduciary financial advisors deliver!

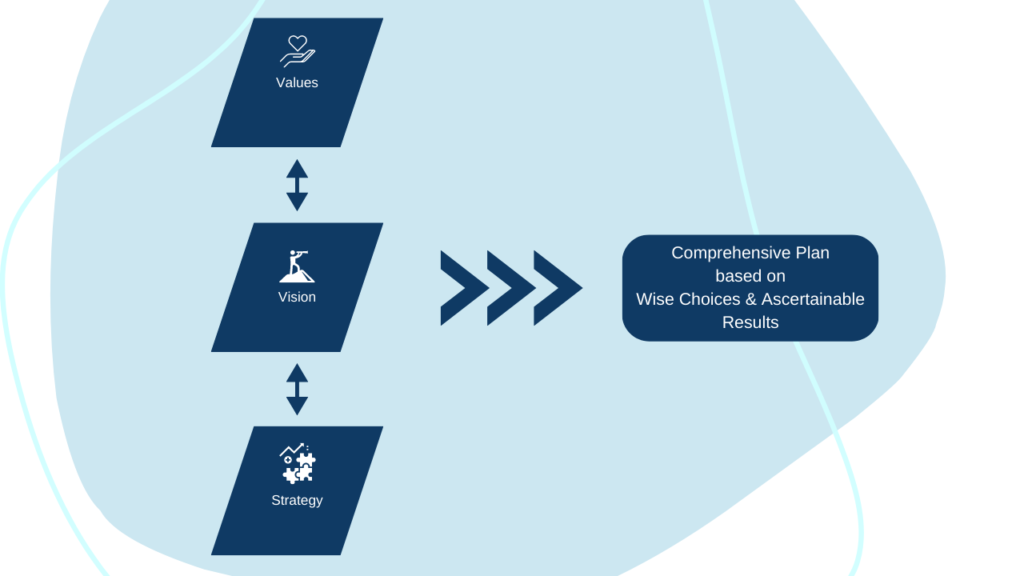

Our Process

We begin with the most important.

Every individual and family has their unique circumstances. Likewise, every individual and family has their unique values, goals, and vision for their future. So, that’s where we start: your values and vision. Then, we connect your financial assets with what is most important to you. It’s a sacred obligation because it involves sacred money: your life’s work.

Wealth management involves more than just financial planning.

Wealth management requires a team of multidisciplinary advisors who are committed to the only goal that matters–helping you achieve your financial plan and live the life you want. Our process of wealth management delivers, because that’s what true fiduciary financial advisors do.

Your financial plan must stay evergreen and evolve to adapt with your life as things change.

Asset Guidance Group allows you to focus on living your life while knowing that your advior is taking care of the planning. our quarterly focus map guides the key planning conversations that your advisors will use to help you navigate the waters you’re sailing as the year progresses.

Objective, client-centric advice

Conventional firms get paid only when you move your investments to their firm. That action results in a conflict of interest. To avoid that result, we simply charge separate fees–one for financial planning and one for investment management. In that fashion, we deliver truly objective advice and remove any conflicts by being fully transparent with disclosures.

-

Essentials Package

* Values and vision * Budget and cash flow * Tax projections * Investment strategy

-

Family Planning Package

* Retirement planning * College education funding * Social security optimization * Insurance planning * Investment strategy * Group benefits planning * Estate planning * Tax return analysis filing * Acces to legal and tax specialists PLUS Everything in Essentials Package

-

Entreprenuer's Package & Advanced Gifting

* Exit and succession planning * Business continuation (buy/sell) * Cash flow and distribution planning * Key employee compensation * Valuation * Insurance audit * Legal audit * Asset protectgion strategies * Retirement plan review PLUS Everything in Family Planning Package

-

Customized Professional Advice for Your Employer-Sponsored 401k/403b Plan

Customized website portal and app giving you personalized advice using your: Available Investment Options that your employer has chosen for you; Adjusted to Fit Your Risk Tolerance; Tailored Only for Morningstar Categories that you choose; “month-to-month” contract (pay by credit card – not plan assets like other fund managers charge); Cancel anytime with 30-day advanced written notice (no one ever cancels!)--If you have more than $30,000 in your employer-sponsored plan, THIS IS FOR YOU!

Invest in Your Future Now!

Asset Guidance Group investment management fees

Cost only becomes an issue in the absence of value.

Superior performance.* No fund fees; No TAMPs; No trading fees. Annual fee billed monthly.

See Forms ADV 2A&2B disclosures

*Past performance is no guarantee of future results.

Books, Whitepapers, and Other Works We've Authored

Awards

- Best Father - by Ashlea Nichols 2021

- The National Association of Experts, Writers & Speakers 2016 Media & Communications EXPY for the Brian Tracy Show

- National Academy of Best-Selling Authors Best-Sellers Quill 2016 for Masters of Success

- Hollywood Live with Jack Canfield 2016

2015 - 2021

- Pack a Sweater

- Masters of Success (Collaborative)

- Advanced Medicaid: Asset Planning, Hearings, Appeals (NBI)

- New Medicaid Rules, Requirements & Changes--Are You Ready?

- The Four Ts of the Retirement Apocalypse

- Protecting Assets While Qualifying for Medicaid (NBI)

- Medicaid Planning: Helping Clients Afford Nursing Home Care (NBI)

- Elder Law: Top Challenges

Our Custodian and Back-Office Money Managers & Analysts

Asset Guidance Group, LLC, has selected Charles Schwab & Co., Inc. as primary custodian for our clients’ accounts.

What They Say About Us*

*All client testimonials are from authentic clients. Such clients voluntarily gave their testimonials. Such clients were not compensated for their testimonials.

These materials have been independently produced by Asset Guidance Group, LLC, a registered investment advisor (“AGG”). AGG is independent of, and has no affiliation with, Charles Schwab & Co., Inc. or any of its affiliates (“Schwab”). Schwab is a registered broker-dealer and member SIPC. Schwab has not created, supplied, licensed, endorsed, or otherwise sanctioned these materials nor has Schwab independently verified any of the information in them. AGG provides you with investment advice, while Schwab maintains custody of your assets in a brokerage account and will affect transactions for your account on our instruction.